Featured

Table of Contents

- – What Financial Obligation Forgiveness In Fact ...

- – The Critical Distinction In Between Nonprofit ...

- – Personal Bankruptcy Therapy: Recognizing Your ...

- – Contrasting Your Financial Debt Relief Options

- – Indication of Financial Obligation Alleviation...

- – Making an Enlightened Choice

- – Taking the Primary Step

When bank card equilibriums spiral beyond control and regular monthly minimal repayments hardly damage the surface area of what you owe, the weight of monetary stress can feel unbearable. With American customers currently holding over $1.21 trillion in charge card debt jointly, discovering genuine debt alleviation has never been extra critical. Almost fifty percent of cardholders lug an equilibrium from month to month, and the portion dropping behind on minimal settlements has increased to 12.3% in recent data.

For those seeking a path out of frustrating financial debt, recognizing the distinction in between financial debt forgiveness, bankruptcy therapy, and financial debt management can suggest the distinction between financial healing and deeper problem.

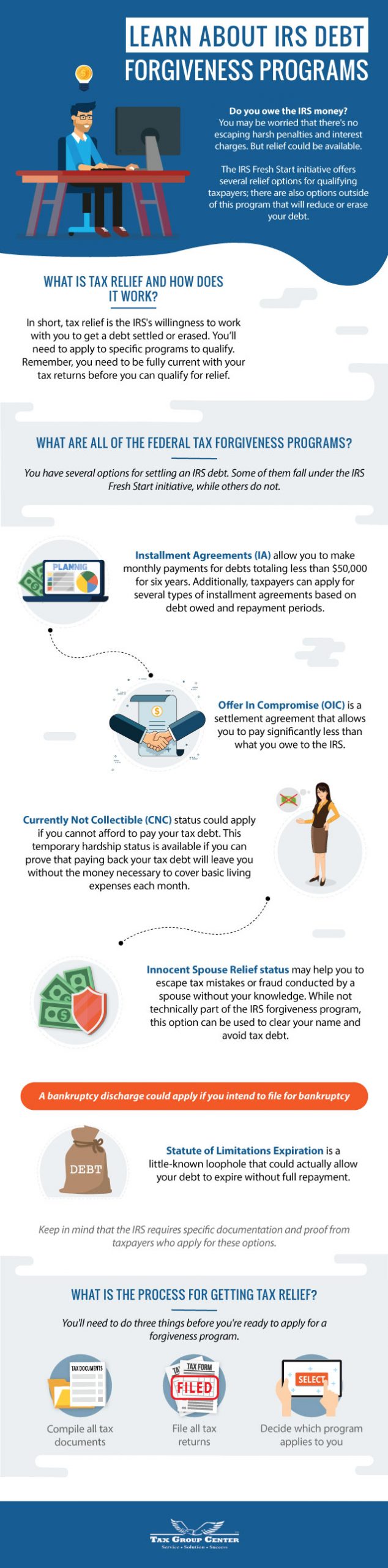

What Financial Obligation Forgiveness In Fact Suggests

Financial debt mercy refers to the process of working out with financial institutions to reduce the total quantity owed, allowing consumers to resolve their debts for much less than the original equilibrium. Unlike financial obligation consolidation, which combines numerous financial debts into a single payment, or debt administration intends that restructure settlement routines, debt mercy programs proactively work to eliminate sections of your impressive balances.

When a bank card account goes unsettled for 120 days or even more, lenders often charge off the financial debt and may approve decreased settlements to recoup at the very least a part of what they're owed. Negotiations typically range from 30% to 50% of the initial balance, though outcomes vary based upon the financial institution, account age, and individual circumstances. Most financial obligation mercy programs span two to four years, needing customers to build funds in specialized accounts while negotiators function with financial institutions.

It's worth keeping in mind that forgiven debt over $600 is generally considered gross income by the internal revenue service. Any individual thinking about financial debt negotiation need to get in touch with a tax obligation expert to comprehend the implications prior to continuing.

The Critical Distinction In Between Nonprofit and For-Profit Services

The Customer Financial Defense Bureau cautions that managing for-profit financial obligation settlement business can be dangerous. These business usually charge costs varying from 15% to 25% of registered financial debt and frequently motivate clients to quit paying totally while arrangements proceed. This strategy can lead to placing late costs, penalty passion charges, damaged credit history, and also lawsuits from financial institutions.

Nonprofit credit report therapy companies run under different criteria. Organizations accepted by the U.S. Department of Justice as 501(c)(3) nonprofits focus on client well-being instead of revenue margins. Their credit score counseling sessions are generally offered for free, and financial debt management program fees are capped at $79 month-to-month nationwide under government laws.

The National Structure for Credit Report Therapy (NFCC), started in 1951, represents the gold criterion for nonprofit monetary counseling. NFCC participant companies should fulfill strict moral criteria, with counselors required to recertify every two years. Research study conducted by Ohio State College found that NFCC credit history therapy clients reduced their rotating financial obligation by $3,600 even more than comparison groups over 18 months complying with counseling, with 70% coverage boosted financial confidence.

Personal Bankruptcy Therapy: Recognizing Your Legal Requirements

For people whose financial circumstances have deteriorated past what financial debt forgiveness or management programs can address, bankruptcy might come to be necessary. Federal regulation calls for anybody declaring for Chapter 7 or Phase 13 bankruptcy to complete both pre-filing credit history therapy and post-filing borrower education and learning programs with an approved company.

Pre-bankruptcy therapy includes a comprehensive testimonial of revenue, financial debts, and costs, in addition to exploration of alternatives to insolvency. The session assists filers comprehend whether personal bankruptcy genuinely represents their best choice or whether other financial obligation alleviation methods may function. Post-filing debtor education and learning concentrates on budgeting, saving, and reconstructing debt after bankruptcy discharge.

Both sessions commonly take 60 to 90 minutes. Charges differ by service provider however usually range from $20 to $50 per course, with cost waivers available for those that certify based upon earnings. Upon conclusion, filers obtain certificates required for their personal bankruptcy petitions.

Not-for-profit agencies like APFSC offer these required personal bankruptcy counseling training courses along with their various other financial debt alleviation services, giving a streamlined experience for those browsing the insolvency procedure.

Contrasting Your Financial Debt Relief Options

Understanding which come close to fits your circumstance needs sincere analysis of your economic circumstances.

Financial debt management intends job best for those who can still make constant payments yet require aid minimizing rates of interest and arranging numerous financial obligations right into solitary regular monthly settlements. These programs generally extend three to five years and pay debts completely, just with far better terms. Credit history commonly improve over time as equilibriums lower.

Financial debt settlement or mercy programs fit those with bigger financial debt tons, typically $7,500 or more, that have currently fallen back on payments and can not realistically pay balances in full. These programs work out minimized rewards however lug credit history repercussions and tax obligation ramifications.

Insolvency supplies the most significant alleviation yet also the most substantial long-lasting credit rating effect. Chapter 7 liquidates assets to release financial debts, while Chapter 13 creates organized settlement plans over 3 to five years. Personal bankruptcy remains on credit scores reports for 7 to 10 years.

Credit scores therapy alone, without enrollment in a certain program, helps those that require budgeting assistance and financial education and learning to avoid future debt problems. These sessions are normally free through not-for-profit companies.

Indication of Financial Obligation Alleviation Scams

Consumers should be specifically skeptical of firms declaring to supply government-sponsored charge card debt forgiveness programs. No such federal programs exist for charge card debt, unlike the forgiveness alternatives available for government student loans. Any type of promotions suggesting or else are likely frauds.

Various other warnings include business that demand big upfront fees before giving services, guarantee specific settlement percentages, tell you to stop communicating with creditors totally, or refuse to clarify their fee structure plainly. Reputable not-for-profit firms supply clear info about prices, timelines, and practical outcomes.

The CFPB advises thinking about all choices prior to engaging any kind of financial obligation alleviation service, consisting of negotiating straight with creditors yourself and seeking advice from with not-for-profit credit counselors who can supply impartial analyses of your situation.

Making an Enlightened Choice

Selecting the best financial debt relief path relies on individual situations, overall debt quantity, revenue stability, and capability to make regular repayments. Free initial consultations from not-for-profit credit report counseling firms aid possible clients recognize their options without high-pressure sales tactics.

Throughout these sessions, accredited counselors assess financial situations, describe offered programs, and create customized recommendations. Whether someone inevitably selects financial obligation mercy, debt administration, personal bankruptcy, or self-directed repayment, beginning with nonprofit guidance guarantees they receive advice focused on their economic wellbeing.

Sector leaders like Cash Administration International, GreenPath Financial Health, InCharge Financial Debt Solutions, and APFSC all give extensive services covering debt therapy, financial obligation monitoring, and bankruptcy education. The majority of offer several get in touch with approaches consisting of phone, online chat, and e-mail, making it easy to begin the discussion.

Taking the Primary Step

Financial recovery hardly ever happens over night. Financial obligation administration strategies typically extend three to 5 years, and financial obligation settlement programs typically need 24 to 48 months of organized cost savings and settlements. The alternative of proceeding to have a hard time with uncontrollable debt while rate of interest substances supplies no course ahead.

For anybody drowning in charge card debt, medical bills, or personal financings, connecting to a nonprofit credit history counseling agency stands for an important primary step. The consultation costs absolutely nothing, brings no obligation, and provides clearness about sensible choices. From there, informed decisions become possible.

When Bankruptcy Counseling Suggests Debt Management or Forgiveness InsteadThe trip from overwhelming financial obligation to financial stability needs dedication, persistence, and professional guidance. With support from trusted nonprofit firms and a clear understanding of available programs, that journey comes to be achievable.

Table of Contents

- – What Financial Obligation Forgiveness In Fact ...

- – The Critical Distinction In Between Nonprofit ...

- – Personal Bankruptcy Therapy: Recognizing Your ...

- – Contrasting Your Financial Debt Relief Options

- – Indication of Financial Obligation Alleviation...

- – Making an Enlightened Choice

- – Taking the Primary Step

Latest Posts

National Programs for The Future of Credit Scoring: Beyond FICO Alternative Data and Financial Inclusion for Dummies

Some Known Details About "Bankruptcy Destroys Your Future" and More Myths

Indicators on Non-Profit Debt Forgiveness Options Compared You Should Know

More

Latest Posts

National Programs for The Future of Credit Scoring: Beyond FICO Alternative Data and Financial Inclusion for Dummies

Some Known Details About "Bankruptcy Destroys Your Future" and More Myths

Indicators on Non-Profit Debt Forgiveness Options Compared You Should Know